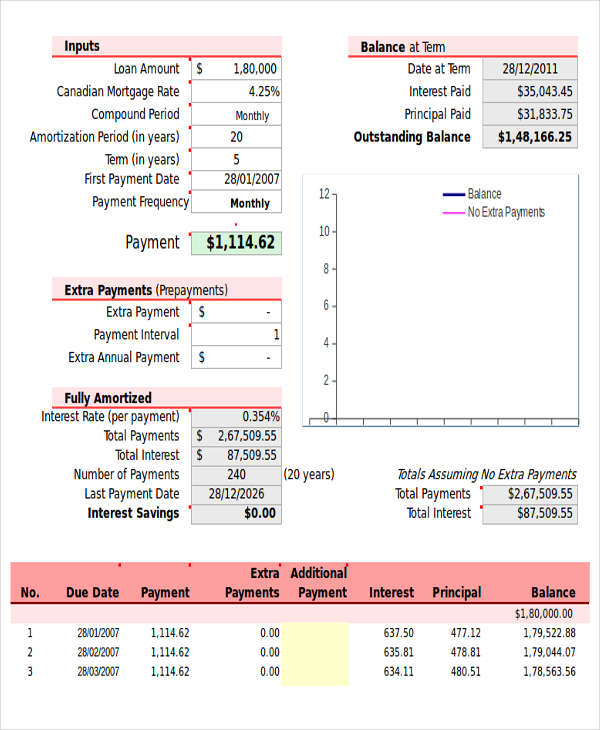

A fixed amount is paid regularly for a shorter time until the final payment is due, which will be substantially higher.A Balloon Mortgage is a long-term mortgage at a low interest rate. Loan repayments are based on the lowest interest rate (either standard variable or 3-year fixed rate, owner occupier) from our lender panel over a repayment.They are also popular among small business owners due to them not having the funds to get a property to run their business from. 'Balloon Mortgages' are commonly taken out for commercial properties due to startup business owners having faith in their business plan and believing they will have sufficient funds when the time comes to pay the final payment. If a 'Balloon Mortgage' is taken out for a real estate property, the lender will most likely ask for proof of a financial plan to demonstrate how the recipient plans on paying the final payment. A 'Balloon Mortgage' is commonly found when it comes to commercial real estate, such as startup business owners, rather than residential real estate, such as future homeowners. Under the month heading, type 0 into cell A8 (the time the loan was issued). The first step is to enter the number of months in the life of the loan. Now it is time to start filling in the table. The final payment of a 'Balloon Mortgage' is very large compared to the previous payments. These are the five headings for the amortization table.

Owner finance amortization schedule full#

You can then print out the full amortization chart. Then, once you have calculated the payment, click on the 'Printable Loan Schedule' button to create a printable report. A 'Balloon Mortgage' allows you to pay smaller payments throughout the time of the mortgage, although it results in a larger balance once the mortgage has matured. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual interest rate. A 'Balloon Mortgage' does not reduce over the chosen term of the mortgage.

Owner finance amortization schedule free#

360 months.This free balloon mortgage calculator will help you calculate your final balloon payment amount for a mortgage with a balloon payment.īalloon Mortgages, compared to other types of mortgages, aren't as common as other mortgages. Mortgage Amortization Schedule: Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance Sep, 2023: 1: 380.63. The seller finance calculator is useful for homebuyers to estimate monthly payments and overall costs. 1Īmortization extra payment example: Paying an extra $100 a month on a $225,000 fixed-rate loan with a 30-year term at an interest rate of 3.875% and a down payment of 20% could save you $25,153 in interest over the full term of the loan and you could pay off your loan in 296 months vs. Seller Financing Calculator is used to calculate the monthly mortgage payments with owner financing. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments.Ĭonforming fixed-rate estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down payment of 20% would result in an estimated principal and interest monthly payment of $1,058.04 over the full term of the loan with an Annual Percentage Rate (APR) of 3.946%. What is the effect of paying extra principal on your mortgage?ĭepending on your financial situation, paying extra principal on your mortgage can be a great option to reduce interest expense and pay off the loan more quickly. It also shows total interest over the term of your loan. Use our mortgage calculator to compare different types of mortgages and loan terms to decide which one works best for you. An amortization schedule shows how much money you pay in principal and interest. This calculator will estimate the mortgage balance owed at the end of the initial payment term when the loan payment has been calculated on a longer term in order to make the payment more affordable in the near term. But, over time, more of your payment goes towards the principal balance, while the monthly cost or payment of interest decreases. Purchase Money Mortgage Amortization Calculator. With a fixed-rate loan, your monthly principal and interest payment stays consistent, or the same amount, over the term of the loan. The buyer and seller will set an amortization schedule and payment plan that needs to be followed. Usually, the buyer will still make a down payment and finance the rest of the purchase with interest.

0 kommentar(er)

0 kommentar(er)